high iv stocks meaning

The ranking is standardized from 0-100 where 0 is the lowest value in recent history and 100 is the highest value. In simple terms its an estimate of expected movement in a particular stock or security or asset.

Lets say a scheduled news event like earnings announcements or planned FDA approvals dont lead to the anticipated sharp rise or drop for the price per share.

. This expected volatility may be higher due to a variety of reasons like corporate announcements. Continue reading What is implied volatility percentile IV. This makes sense if you take this to its logical conclusion.

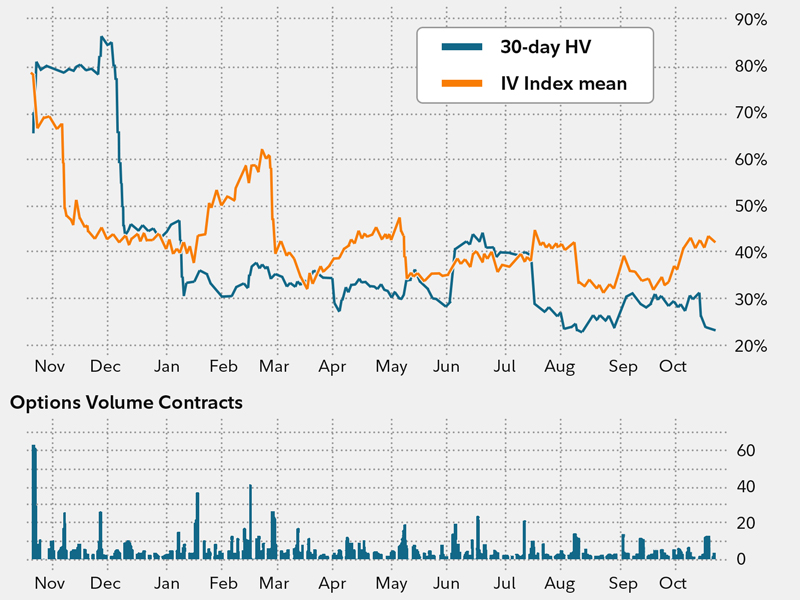

High IV strategies are trades that we use most commonly in high volatility environments. Posted on May 1 2020 by Ali Canada - Options Trading Stock Market Training. These are High volatile stocks NSE.

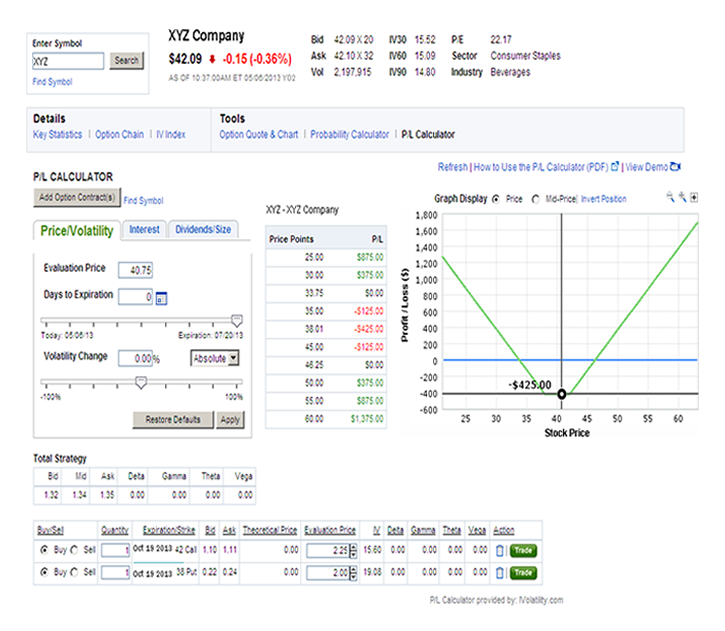

When implied volatility is high we like to collect creditsell premium and hope for a contraction in volatility. Unfortunately this implied volatility crush catches many options trading beginners off guard. As of 27th June 2021 the image also reflects its current price Market Capitalization etc.

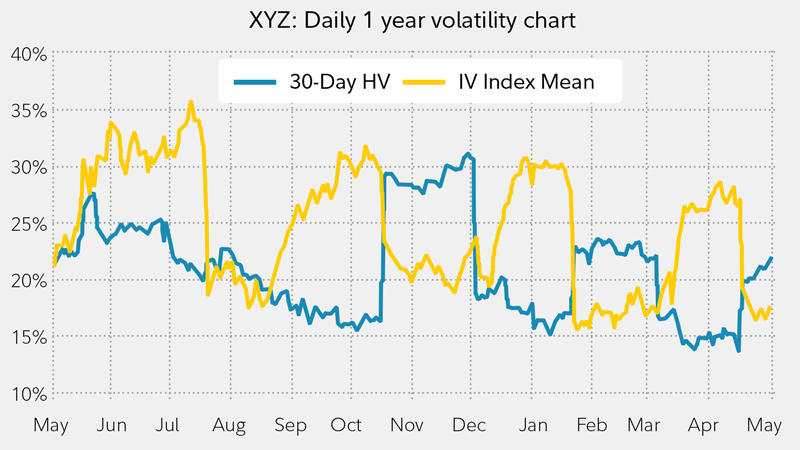

So in general a high IV rank means that a stocks premiums are historically very high creating a. The level of the implied volatility of an option signals how traders may be anticipating future stock movements. IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year.

High IV Options Trading. Even more the 30 IV stock might usually trade with 20 IV in which case 30 is high. To option traders implied volatility is more important than historical volatility because IV factors in all market expectations.

Volatility can benefit investors from every point of view. The data is from November 30 2021. If a stock is 100 with an IV of 50 we can expect to see the stock price move between 50-150.

Implied Volatility is the expected volatility in a stock or security or asset. All stocks in the market have unique personalities in terms of implied volatility their option prices. IV crush is the phenomenon whereby the extrinsic value of an options contract makes a sharp decline following the occurrence of significant corporate events such as earnings.

IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past. Learn how Implied Volatility IV can be a valuable tool for options traders to help identify stocks that could make a big price move. This is the historical stock volatility measured using the Open-High-Low-Close calculation.

This value tells us how high or low the current value is compared with the past. High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year. Displays equities with elevated moderate and subdued implied volatility for the current trading day organized by IV percentile Rank.

It means that the market expects the stock to be some percent away from its current price by the time the option expires. Implied volatility is not by itself a directional indicator. Four Things to Consider When Forecasting Implied Volatility.

It is a percentile number so it varies between 0 and 100. A high IVP number typically above 80 says that IV is high and a low IVP. The term volatility crunch is used to describe an occurrence where a high IV drops dramatically and quickly.

An IV crush happens when the anticipated move on an underlying stock does not occur. Historically implied volatility has outperformed realized implied volatility in the markets. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account.

On the other hand the 50 IV stock might usually trade with 75 IV in. It is also a measure of investors predictions about future volatility of the underlying stock. Put simply IVP tells you the percentage of time that the IV in the past has been lower than current IV.

The higher the IV the higher the premium of the option. This volatility is annualized -- meaning it represents the. For this reason we always sell implied volatility in order to give us a statistical edge in the.

For example one stock might have an implied volatility of 30 while another has an implied volatility of 50. Implied volatility rises when the demand for an option increases and when the markets expectations for the underlying stock is positive. If IV Rank is 100 this means the IV is at its highest level over the past 1-year.

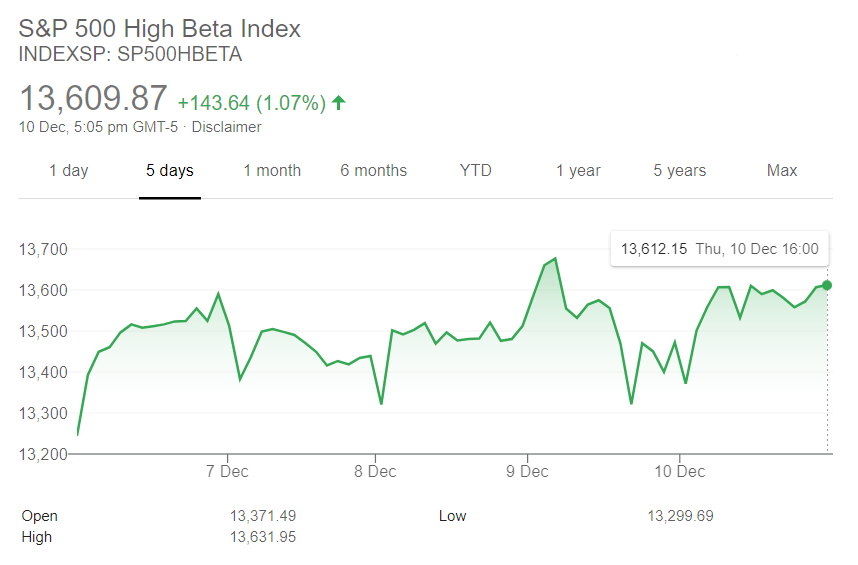

The implied volatility is high when the expected volatilitymovement is higher and vice versa. The above list displays 22 high volatile stocks with high beta. You will see higher-priced option premiums on options with high volatility.

The scanner is useful if you plan on trading options using popular Theta Gang strategies such as The Wheel and the Cash-Secured Put or even Vertical Spreads. It typically happens to stocks following a significant event that was expected such as the release of earnings reports or important news like in the above example. An options strategy that looks to profit.

So a high IV rank alerts us to a premium-selling opportunity while a low IV rank might inspire us to buy premium if we have a directional bias on the security. These strategies tend to be more successful on stocks with a high IV rank and high IV percentile. Options serve as market based predictors of future stock volatility and stock price outcomes.

IV crush stands for implied volatility crush and goes along with a sudden drop in previously increased implied volatility. By understanding both IV and IV rank you can determine the true nature of a stocks volatility. Make sure you can determine whether implied volatility is high or low and whether it.

Now in the Beta filter just change it to High so that it can only find high Beta Stocks. If the implied volatility is high the market thinks the stock has potential for large price swings in either direction just as low IV implies the stock will not move as much by option expiration. Implied Volatility percentile is a ranking method to compare implied volatility to its past values.

Take Advantage Of Volatility With Options Fidelity

:max_bytes(150000):strip_icc()/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)

Use Options Data To Predict Stock Market Direction

Take Advantage Of Volatility With Options Fidelity

3 Option Trading Strategies To Profit In A High Volatility Market Guestpost

What Is High Iv In Options And How Does It Affect Returns

High Beta Index Overview How Beta Works Attractiveness

What Is Volatility Skew And How Can You Trade It Sofi

Calendar Spread Options Strategy Fidelity

What Is Volatility Definition Causes Significance In The Market

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

Implied Volatility And Options Options For Volatility Course Youtube

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

/skwesmile-56a6d2125f9b58b7d0e4f70a.gif)

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)

:max_bytes(150000):strip_icc()/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/skwesmile-56a6d2125f9b58b7d0e4f70a.gif)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)